Does Anyone Really Know?

If you’re somewhat confused about mortgage interest rates you are certainly not alone. In recent weeks we’ve seen VA loan rates increase dramatically, then retreat, then creep up again and, yet again, retreat from their highs. Let us begin by stating the oft repeated phrase “NO ONE KNOWS WHAT FUTURE RATES WILL BE”. We emphasize no one because of its importance in the statement. No one includes these we’ve come to rely on in the marketplace. This unpredictable future of rates seems to be complicated by an apparent lack of focus at the Federal Reserve as was pointed out in a recent Wall Street Journal opinion piece by University of Chicago trained Economist David Barker:

“The Federal Reserve’s credibility is in tatters. It predicted low inflation through 2021 even as the money supply exploded and higher inflation followed…But instead of lowering inflation and preventing recession, many of the Fed’s 400 economists are busy fighting climate change.”

Given the recent moves by the Fed it is apparent they believe a need for an increase in interest rates may be reduced. History, however, shows us inflation may only be tamed by still higher rates which may place us in a recession. This same history tells us the Federal Reserve’s interest rate (aka the Fed Rate) needs to be higher than the inflation rate. We are much below that rate yet the housing sector is already in a recession. The future of this sector is predicted in an analysis from the consultancy firm Deloitte:

“The housing sector outperformed the broader economy in the wake of the pandemic, as buyers and sellers found ways to navigate the pandemic’s restrictions. But the tables have turned. As the Fed has raised interest rates and inflation appeared, long-term interest rates have moved up dramatically. The result is a decline in housing starts from 1.7 million in Q1 2022 to 1.4 million in Q4. And house prices, which rose sharply starting in the middle of 2021, have stabilized and even started to fall in some places. Lower house prices will not be able to solve the affordability problem, however, because of the jump in mortgage rates…Deloitte expects the fall in construction to end by the middle of this year. Housing may bounce back for a year or two after the current downturn runs its course.”

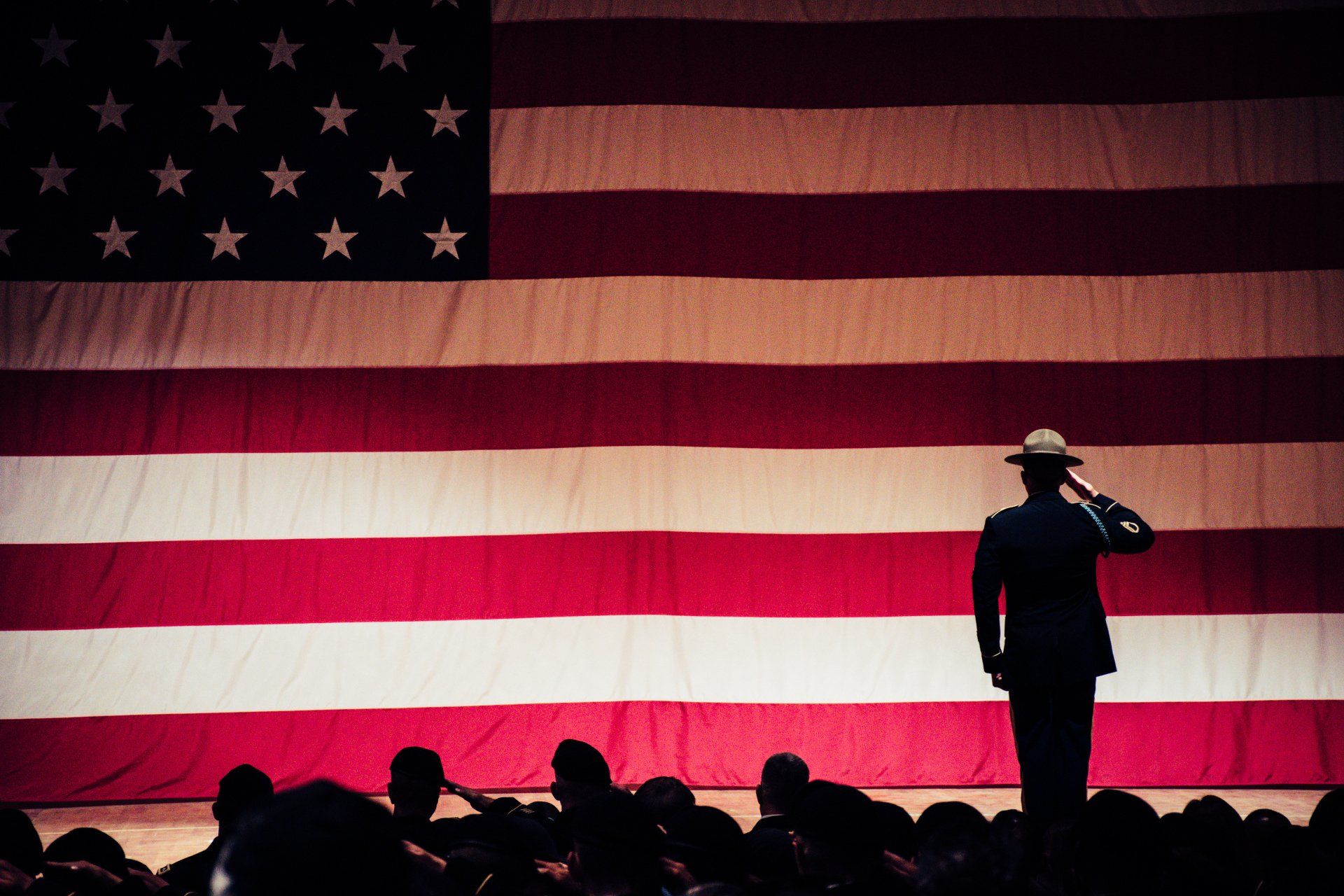

But, no matter the ups and downs of rates or housing values, we believe the VA Loan benefit you’ve earned is still a very strong contender in the market place. If you purchase a home today and rates climb in the future you’ll feel like a genius. If, on the other hand VA loan rates decrease you are fortunate to be able to use the streamline refinance program available at VALOANSMN. For details on that benefit we encourage you to call Brad at 612-240-9922.

Got a Question?

Do you have a question? We can help. Simply fill out the form and we'll contact you with the answer, with no obligation to you. We guarantee your privacy.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Brad Christensen

Mortgage Loan Originator

NMLS# 290074

612-240-9922

2523 S. Wayzata Blvd. Suite 300

Minneapolis, MN 55406

© 2024 All Rights Reserved | Luminate Home Loans, Inc.

Privacy Policy |

Company Licenses |

NMLS Consumer Access NMLS# 150953

Brad Christensen NMLS#290074 works for nationally recognized Luminate Home Loans, Inc. NMLS#150953. VALoansMN is not affiliated with the Veterans Administration or any government agency. Luminate Home Loans, Inc. NMLS# 150953 Corporate Headquarters: 2523 S. Wayzata Blvd #300,Minneapolis, MN 55405. NMLS ID #150953 http://www.nmlsconsumeraccess.org. Toll Free (800) 270-3416. This advertisement does not constitute a loan approval or a loan commitment. Loan approval and/or loan commitment is subject to final underwriting review and approval.